nevada vs california income taxes

Whether youre a doctor teacher real estate agent or entertainer. Nevada on the other hand is known to tax less.

What Are Employer Taxes And Employee Taxes Gusto

Each year on July 1st the Treasurer-Tax Collector has the power to sell properties that have been in default delinquent on the property nevada sales tax vs california taxes for.

. Assume you have a sale for 1000000 in Nevada and California. Also the list of common. The cost of Nevada vs California formation is almost the same.

Taxpayers in Nevada get to enjoy one of the most tax-friendly situations in the nation. Use this tool to compare the state income taxes in California and Nevada or any other pair of states. Nevada taxes will stay the same through the end of the fiscal year.

Taxes on a 1000000 is approximately 6000. The most significant taxes you pay in Nevada. Incorporating in Nevada instead of California may provide you with tax savings and other corporate protection benefits.

Owing to this a Nevada LLC is able to leverage this structure by having limited tax liabilities. To register for the Nevada Commerce Tax you must fill out a Nevada Nexus Questionnaire and mail it to the Nevada Department of Taxation. Creating an LLC in California the state filing fee is 70 whereas in Nevada its 75.

The state of California ranks 40th in corporate tax rankings according to the Tax Foundation. This tool compares the tax brackets for single individuals in each state. Property Tax In Nevada vs.

The state of California requires residents to pay personal income taxes but Nevada does not. This rate however does. In California C-corporations are taxed at a rate of 884 on the net taxable income with the minimum tax being 800.

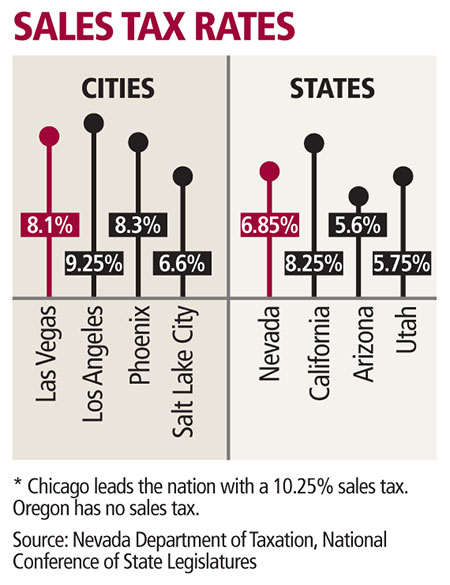

View a comparison chart of California vs. Local sales taxes increase this total with the largest total rates hitting 105. This adds a significant toll to.

Since the cost of living is much higher California has taxes on almost everything. In California the state income tax is 10 and. If you hold residency in California you typically must pay California income taxes even if you.

With a top marginal income tax rate of 123 percent Nevada vs California taxes are known for having the highest state income tax bracket in the country. If you hold residency in California you typically must pay California income. This rate is higher than the average in.

Typically taxes on Incline Village. The state of California requires residents to pay personal income taxes but Nevada does not. Interestingly the neighboring state of Nevada is ranked number one.

As such Nevada rules arent. Nevada provides an extensive gaming culture that generates a lot of tax income for the state. Use this tool to compare the state income taxes in Nevada and California or any other pair of states.

For more information about the income tax in these states visit the. This tool compares the tax brackets for single individuals in each state. In Nevada the state tax rate is 18 and the state sales tax is 9.

Consumers in California are hit with a sales tax of 725. I think it is important to note the rates in the states as well.

Nevada Vs California Taxes Retirepedia

States With The Highest Lowest Tax Rates

California Income Tax Calculator Smartasset

State W 4 Form Detailed Withholding Forms By State Chart

Income Taxes How To Calculate Them Google Slides And Ppt

The Most And Least Tax Friendly Us States

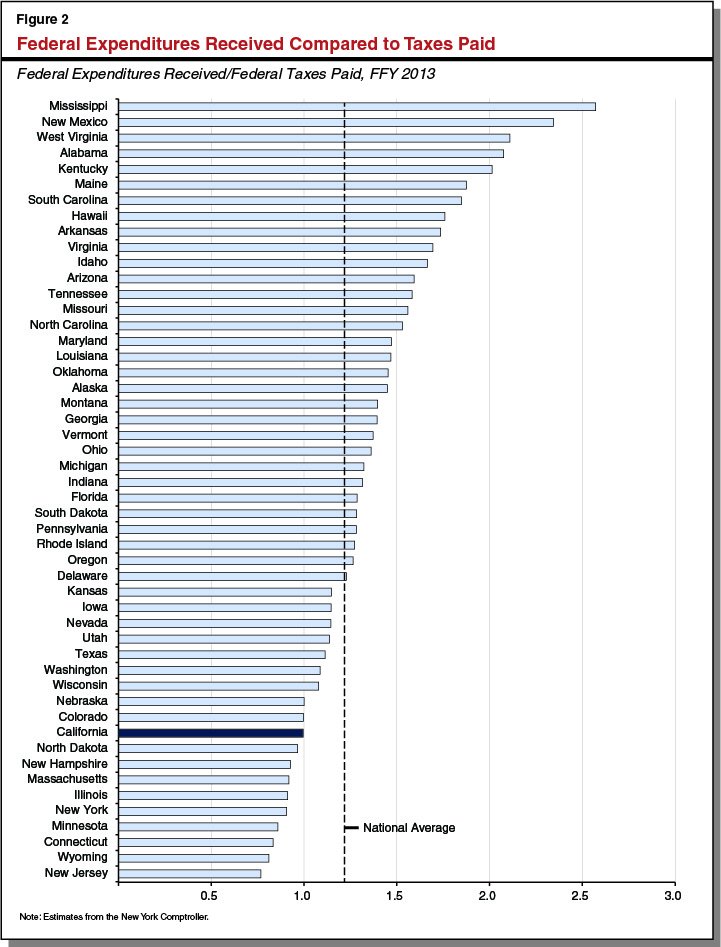

Legislative Analyst On Twitter California Receives 0 99 In Federal Expenditures Per Dollar Of Taxes Paid Below The National Average Of 1 22 Https T Co U2wjomsexc Https T Co Z5nxdsre8n Twitter

Hyatt Vs Ca State Franchise Tax Board Complete Defense Judgment 2m Million Awarded In Costs 24 Years Of Litigation Mcdonald Carano

Moving Avoids California Tax Not So Fast

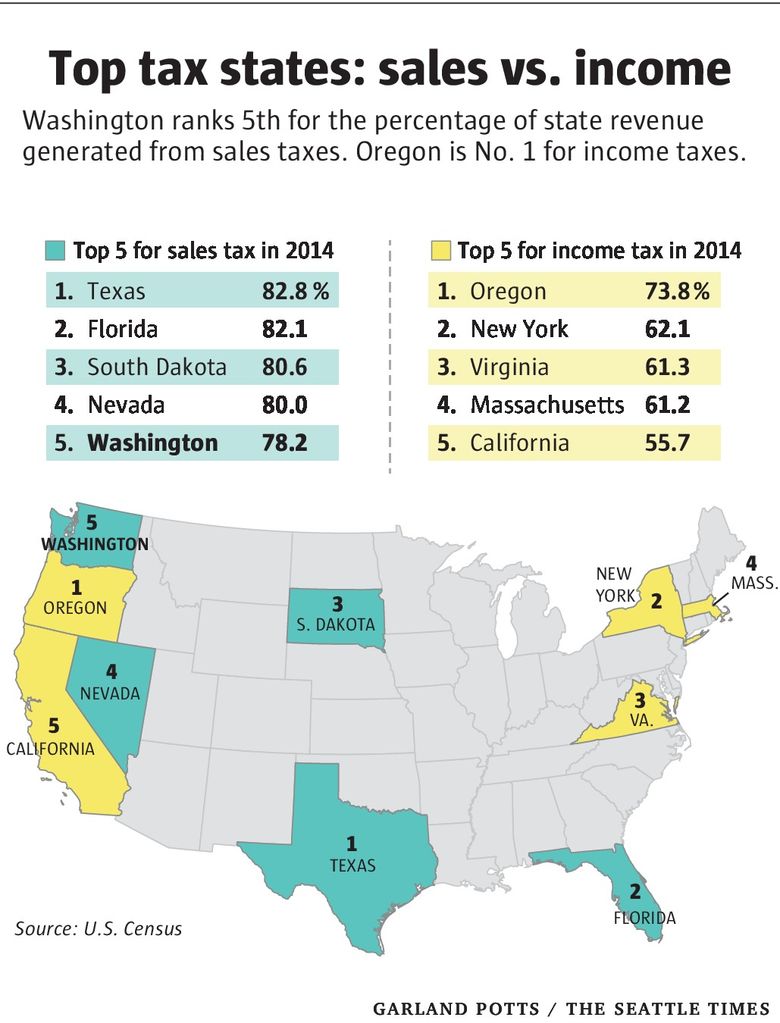

Taxes Like Texas Washington S System Among Nation S Most Unfair The Seattle Times

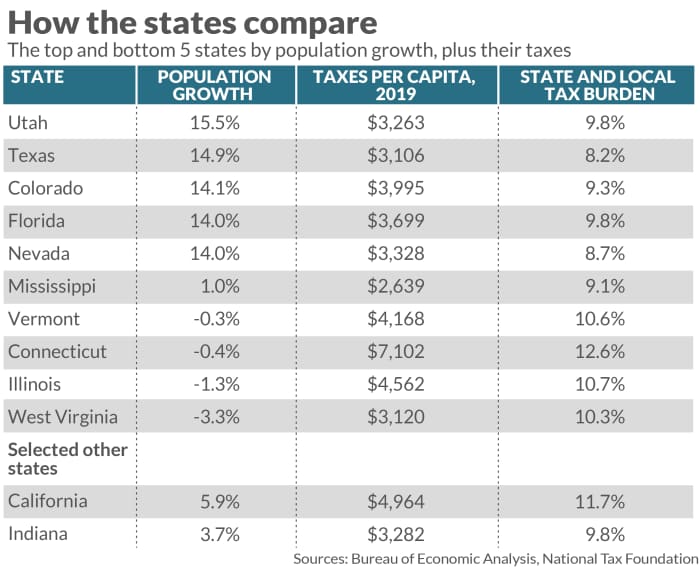

Opinion As Elon Musk Moves Tesla To Austin Some Surprising Lessons About Low Taxes And Economic Growth From Texas And California Marketwatch

Nevada Vs California For Retirement Which Is Better 2020 Aging Greatly

Taxes About To Increase Las Vegas Review Journal

Nevada Vs California Taxes Retirepedia

2022 Federal State Payroll Tax Rates For Employers

Is Living In A State With No Income Tax Better Or Worse Bankrate